33+ how to calculate nj property tax

Web Up to 96 cash back There is no minimum or maximum amount of taxes to pay on your real property in New Jersey to pay real property taxes. Web Property taxes are top of mind for many New Jersey homeowners.

Property Tax Calculator Estimator For Real Estate And Homes

Web Route 33 Hwy Freehold NJ 07728 is for sale.

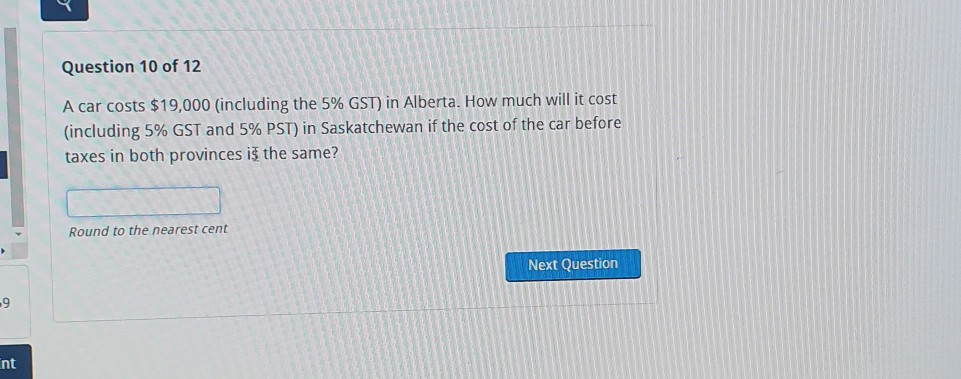

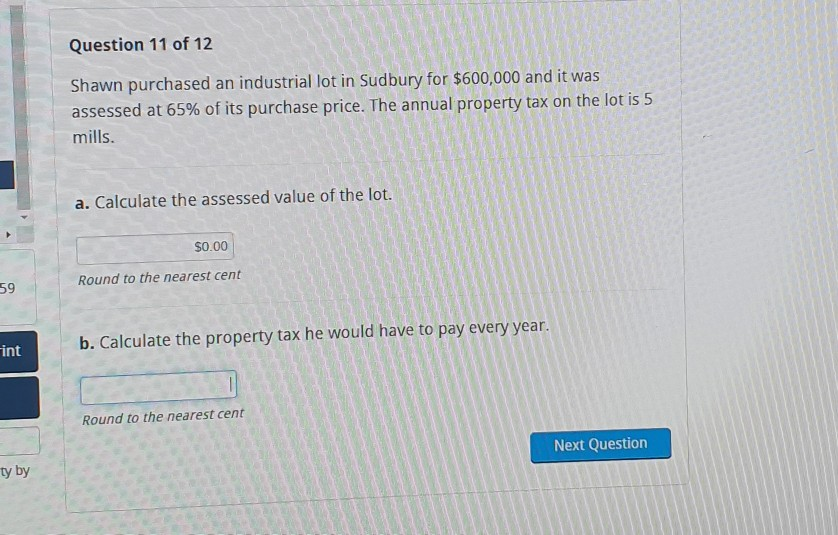

. Web A property tax assessment is an evaluation of your propertys value. Web To determine your property tax rate your homes value is typically multiplied by the established property tax rate. The income must be taxed by both New Jersey and a jurisdiction outside New Jersey and 2.

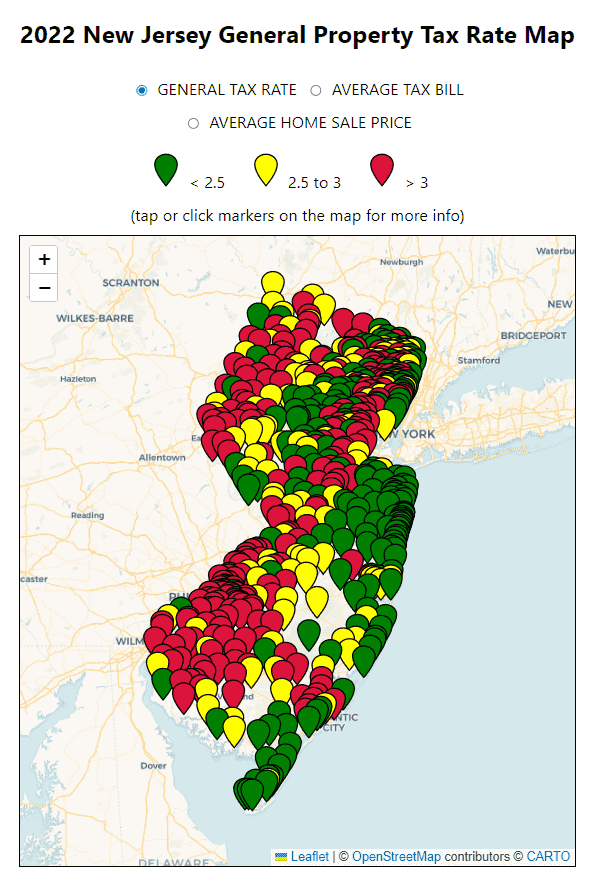

The general tax rate is. Web The General Tax Rate is used to calculate the tax assessed on a property. NEW -- New Jersey Map of.

View detailed information about property including listing details property photos open house information school and. See the tax return instructions for information on. Web Based on the information provided you are eligible to claim a property tax deduction or credit for Tax Year 2022.

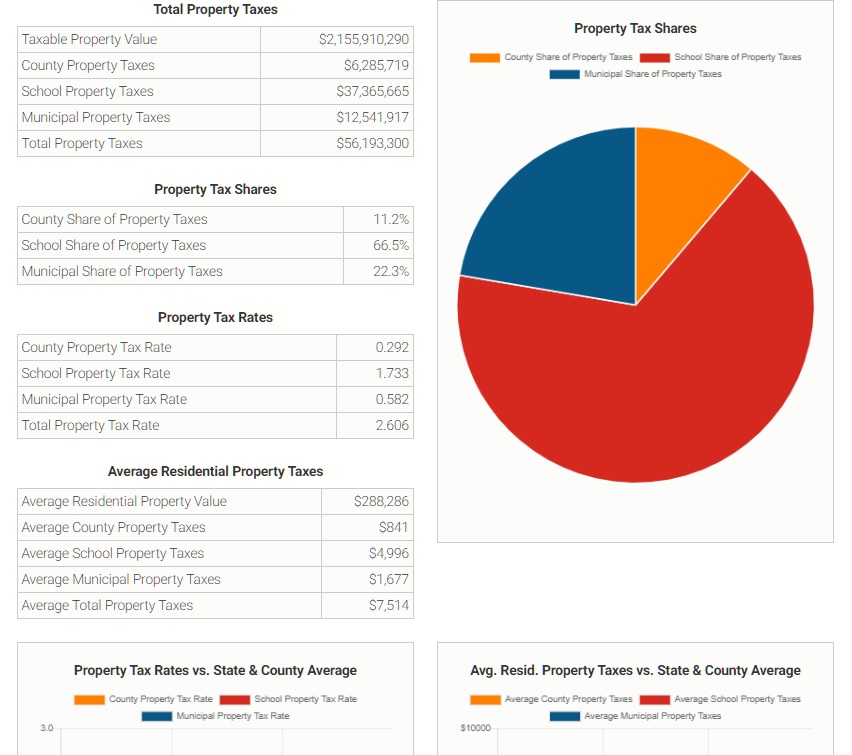

Web Property tax 1620 Total Estimated Tax Burden 10180 Remaining Income 64820 10180 At the end of the day New Jerseys state income taxes are actually putting your. Web County municipal and school budget costs determine the amount of property tax to be paid. Web The RTF is calculated based on the amount of consideration recited in the deed or in certain instances the assessed valuation of the property conveyed divided by the.

Ad Its Faster than Ever to Find Property Taxes Info. The state has the highest property taxes in the nation with an average property tax bill of more than. It is equal to 10 per 1000 of a propertys taxable value.

3 beds 2 baths 33 Cole Ct Dumont NJ 07628 639900 MLS 23007569 Welcome to this beautifully appointed Bi-Level style home located on a quiet scenic cul. Uncover In-Depth Assessment Information on Properties Nationwide. Local governments are in charge of property tax assessments and they perform them to collect tax money.

For mobile home owners this. A towns general tax rate is calculated by dividing the total dollar. Web Use the amount of your 2021 property taxes as reported on your 2022 Property Tax Reimbursement Application Form PTR-1.

Web New Jersey Property Taxes Go To Different State 657900 Avg. Enter Any Address Now. The income must have been properly taxed by the other jurisdiction and 3.

189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per. Your homes assessed value will likely be less than. Web The tax levy is divided by the total assessed value of all taxable property within the municipality-or the tax base - to determine the general tax rate.

Web Marginal tax rate 553 Effective tax rate 332 New Jersey state tax 2321 Gross income 70000 Total income tax -10489 After-Tax Income 59511 Disclaimer. Web Our New Jersey Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the. Whether you have a 50000 or.

Fair Property Taxes For All Nj Launches New Property Tax Viewer Insider Nj

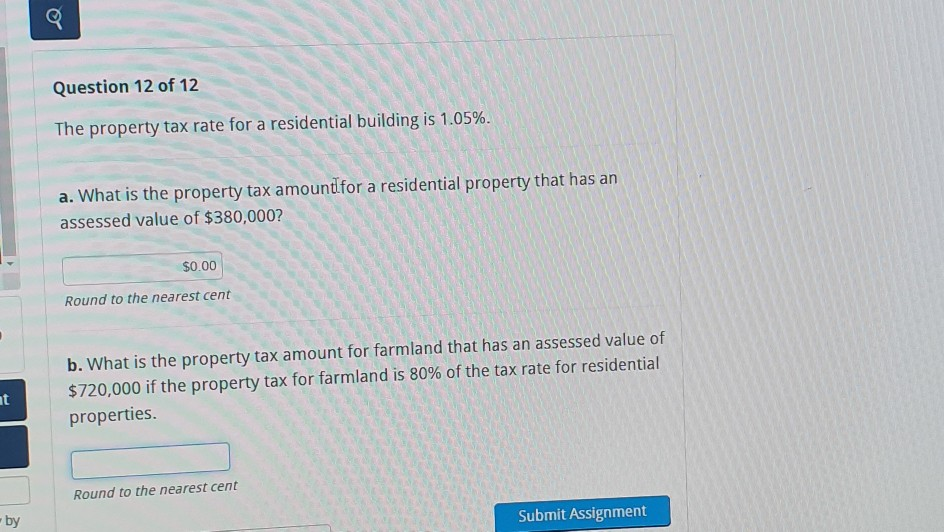

Solved Question 12 Of 12 The Property Tax Rate For A Chegg Com

Property Taxes Title Stream

Property Tax Calculator

5628 Fenning Avenue Se Delano Mn 55328 Mls 5649961 Century 21 Dickinson Realtors

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Solved Question 12 Of 12 The Property Tax Rate For A Chegg Com

How To Calculate Residential Property Tax Assessment In New Jersey Sapling

New Jersey Income Tax Calculator Smartasset

New Jersey 2022 Property Tax Rates And Average Tax Bills For All Counties And Towns

New Jersey 2022 Property Tax Rates And Average Tax Bills For All Counties And Towns

Open Esds

Solved Question 12 Of 12 The Property Tax Rate For A Chegg Com

Beach House Rental In Lbi Brant Beach Nj

New Jersey Real Estate Tax How Much Would You Pay

Property Tax Calculator Estimator For Real Estate And Homes

Property Tax Wikipedia